What I Learned Going From Creator to Founder (Part 1)

Reading time: ~15 mins

I often get questions about lessons I’ve learned as a public equity investor-turned creator-turned founder. This series shares those lessons. Whether you’re a corporate employee, an investor, or a founder (especially a creator-turned-founder), I hope you find value in ideas that have reshaped how I think about work, money, and the world more broadly.

Public Equities Professionals Are Training AI Models As Latest Exit Opportunity

Ex-finance professionals are now training Endex, the Excel agent backed by OpenAI. They’re teaching Endex’s models how Wall Street actually builds DCFs and LBOs.

Firms are leveraging AI tools as a path to streamline tasks that used to take investors hours.

Frontier AI labs project significant improvements in Excel capabilities after the next year.

You can request access to Endex or apply to join.

You have to be valuable to make big money

The highest-paid jobs all work the same way: your pay is tied to the value you create.

Investment banking MDs and partners at consulting firms and law firms don’t really care about base salary. They know real money comes from how much business they bring in—and in theory, there’s no cap on that. CEOs are the same. Stock options are what actually matter if they hit their targets. Portfolio managers don’t care about base pay either, because their bonus depends on how much dollar alpha they generate.

The pattern is pretty clear: at the top, pay scales with impact. If your compensation isn’t tied to value creation, you end up spending your entire career chasing higher salary bands—and salary has a hard ceiling. You can now stop complaining about why MDs don’t do slide work or financial modeling, their job is to golf with CEOs in hopes of getting businesses.

Founders are this idea on steroids. You start with nothing. No product. No brand. No distribution. You don’t get paid at all unless customers actually want what you’re building and are willing to pay for it. It’s as real as it gets.

Even coming from a hedge fund, a performance-driven pay scheme, being a founder has made this lesson hit harder. I have to add value. If I don’t, I make $0 and no meals on the table until then.

What does this mean for you?

You need to choose a career where you can add the most value, instead of choosing one that pays the most. If you are not particularly good in the field you chose and the field pays a lot because it adds big value to the world, you won’t get rich along with the industry.

You should live every single second of your life thinking about how to be of value to everyone around you – your family, your friends, your manager, your team, and your firm. The more valuable you are, the market will find a way to pay you - either at where you are today or somewhere else that’s willing to pay you more fairly.

I am able to do what I do today full-time not because I am the greatest investor - I was not in the investing profession for long. I generate enough revenue today because I am resourceful, pay attention (to problems) and take action (more on this point later in this article.)

If you want to be ahead of 95% of your peers in understanding how to get rich, I highly recommend you read my book summary of The Almanack of Naval Ravikant.

Entrepreneurship is way harder than day jobs

There’s a reason why most people work for others—and a reason why most of the richest people in the world are entrepreneurs (or inherited from one).

When you work for a company, a lot is done for you. The product exists. The sales channels are built. The brand is established. There’s stability. Your experience fits neatly into a defined career path you can take to another employer. You get paid a fixed amount, like a bond.

A startup starts with nothing. No product. No distribution. No brand. About 95% of startups fail within five years. It’s stressful, unstable, and often lonely. As a founder, you build everything from scratch with no guarantee it’ll work. You learn to build a product, sell it, create a brand, deal with customers, and comply with laws—all at the same time.

So what do founders get in exchange?

Leverage. Leverage over capital, labor, and distribution—especially today, when the AI and internet have slashed the cost of building and scaling. You hear stories about people working five hours a week and making six figures a month. That’s totally doable. What doesn’t get talked about is the years of 100-hour weeks making $0 to get there.

There’s also equity.

When you retire from a corporate job, back in the day you at least walked away with a defined-benefit pension (no, not that 401K crap) that pays you for life. Today, you walk out the door. Maybe they throw you a retirement party. You can’t sell your seat for cash. Yay.

A business, on the other hand, can have real exit value—assuming it isn’t a melting ice cube. As the business grows, your net worth grows with it.

I doubled my business’s revenue in a single year by launching a new product. When your employer launches a product that doubles company revenue, your salary doesn’t double.

I also don't deal with incompetent managers or needing to hop on "quick calls." when an email can do.

If everyone were capable of building a business that reaches product–market fit, almost no one would choose to work for someone else. It is just, all the perks associated with entrepreneurship are hard

You are no longer evaluated on input

As a founder, the link between effort and income breaks.

When you work for a company, you usually have to put in at least 40 hours a week to earn a fixed salary. As long as you’re not completely useless, you keep clipping that paycheck.

Entrepreneurs don’t get paid at all until they reach product–market fit—and there’s no guarantee they ever will. Customers don’t care how hard you work or how smart you are. If your product doesn’t solve a real problem or isn’t priced right, they simply won’t pay.

That’s both the downside and the upside to the effort-income breakage.

The downside is that effort alone means nothing. You can work nonstop and make zero dollars. The upside is that if you know what you’re doing and produce real results, leverage (capital, employees, internet / AI) allows you to turn your input (knowledge, effort, vision) into 10x or even 100x the financial output.

In that sense, entrepreneurship is a lot like the buy-side. Clients, who entrust their capital with you, don’t care how you generate alpha. You can work 80 hours a week and lose money, or work 10 hours a week and beat the market.

That’s not to say hard work doesn’t matter. In reality, value tends to flow to people who work harder and make better decisions than others.

The reason founders earn most of the upside isn’t effort — it’s ownership and risk. If that feels unfair, the fastest way to understand why it exists is to try starting something yourself. Reality teaches the incentive structure better than any debate.

You cannot only be motivated by money

A while back, at a book club I was attending, I told someone I work full-time on my creator business. She immediately jumped to asking how to start a YouTube channel to make money. All she asked was how much money I make, what products I sell and what's my revenue model, in that order.

I didn’t bother correcting her, but I knew she would likely give up and fail because her mind was at the wrong place.

There’s nothing wrong with wanting to make money. I like money. Who doesn’t? But money is a weak motivator when things get rough for founders and 100% of the time it will get hard. That’s why Jensen Huang wishes you “great amount of pain and suffering.” but there will be lots of it. I attest to that, however miniscule what I do versus what founding Nvidia was like.

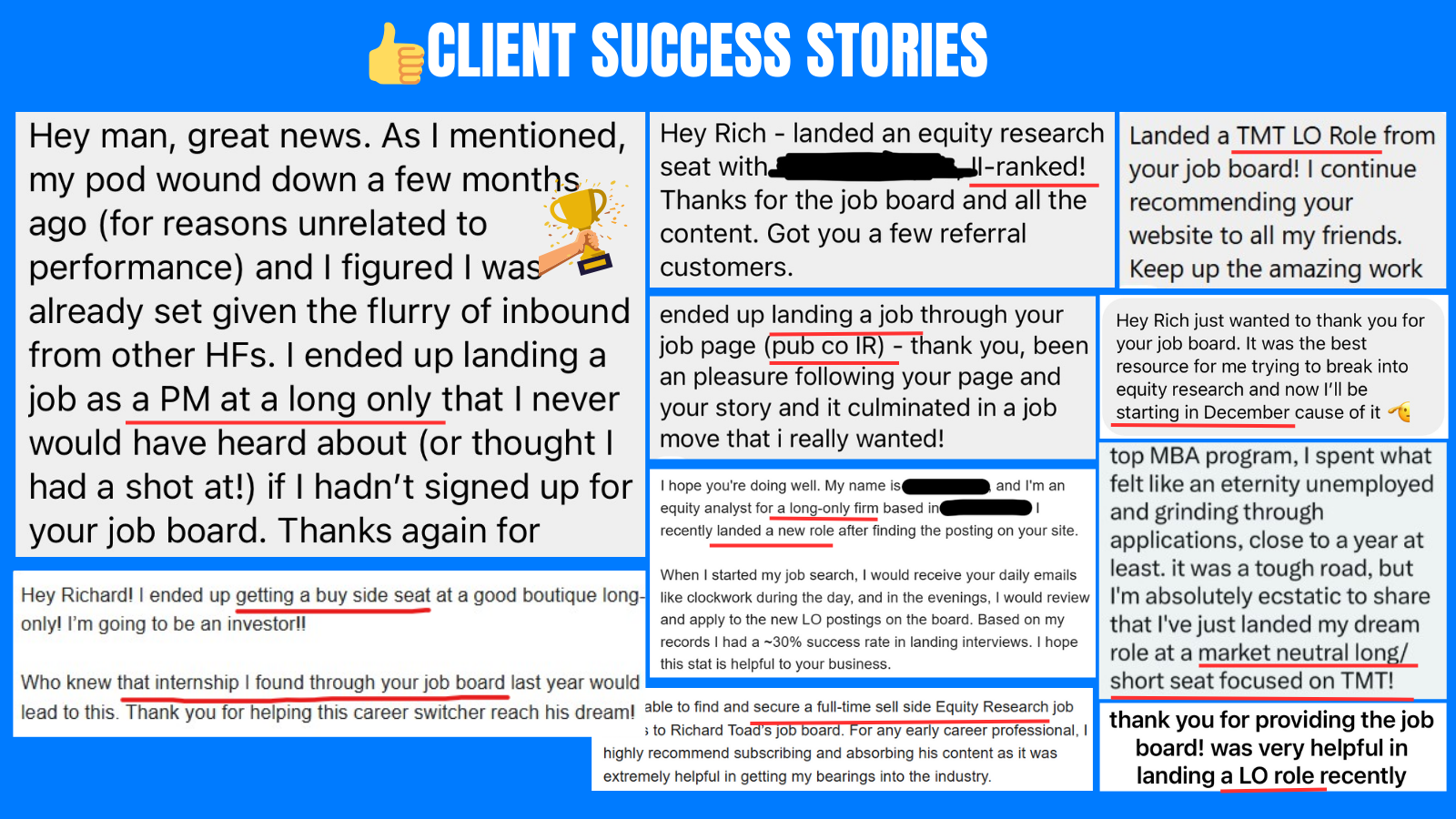

I didn’t start Richard Toad to make money. Those who have supported me since before 2022 know that. I wanted to help people with their careers and I was always good at it before I was ultra-niche micro-famous. Over time, that turned into an audience. With 80,000+ followers across the internet, it’s safe to say you like what I have to say.

Going from creator to paid products was not trivial either. People don’t like paying for things (lol—big surprise!) But I made it work, only after two years of making pretty much no money. Today, a lot of the heavy lifting is done by my paying customers, who tell others how my products actually solve their problems.

That’s the key point: making money is a byproduct of solving problems well. You can’t build a defensible, long-term business if you don’t first build trust, reputation, and a brand people believe in.

The most dangerous thing about focusing on money too early is that it pushes you into short-term decisions that hurt you long term. You might partner with the wrong advertisers. You squeeze nickels and dimes out of your audience. And in the process, you lose trust—which is almost impossible to get back.

So focus on solving a problem first, then the money will come over time. Even the world’s biggest businesses were started because the founders genuinely want to solve a problem.

You need to act

I’m not smarter than all of you. I just took actions because I had no choice - I quit my hedge fund analyst job without a job lined up and I struggled to land a corporate job.

My first product of selling coaching hours had virtually no interest. I kept pivoting, kept learning from others online, and I have been wildly consistent with content creation all during that time, thanks to having been a creator before being a founder where consistency wins.

That’s my “secret sauce”—and it’s the secret sauce for a lot of people who look successful from the outside. Action is key.

In investing, you can do all the analysis in the world, buy the stock, and still watch it tank. It sucks—but that’s how you learn.

As a creator, you have to post content, look at the analytics, see what gets reach, and double down on a format that works. And then, inevitably, it stops working—because platforms themselves can’t figure the fuck out what types of creators they want to serve. It’s frustrating, but that’s creator life.

Founders live this too. You have to launch the damn product. You will almost certainly run into problems you didn’t anticipate. What matters is your resilience in solving them. That’s what makes or breaks a founder.

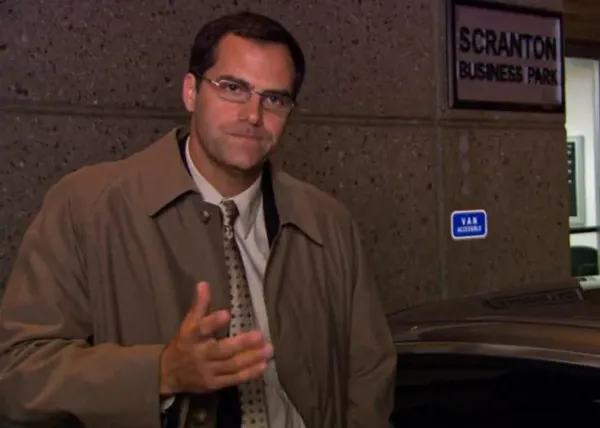

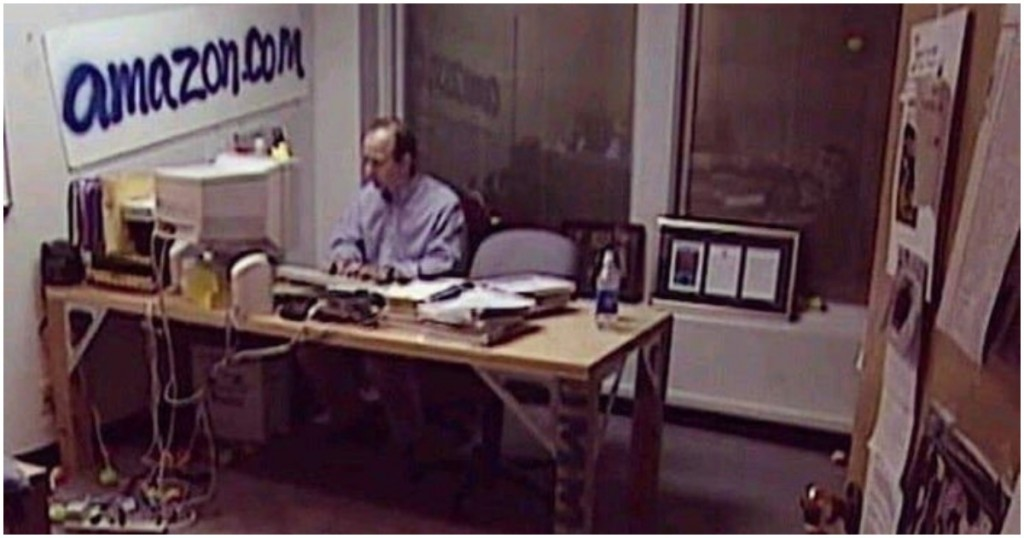

Stop thinking and wondering, START. No one pays you for “oh I always thought about starting this business.” Well, you didn’t make it happen. Selling books and making electric cars are easy to say, but Jeff Bezos and Elon Musk made them happen. Bezos had to ship packages himself during holidays in Amazon’s early days and Elon Musk lived in the factory. Everybody wants to go to heaven but nobody wants to die.

My job board today looks nothing like the version I launched in January 2024. I’ve refined it, expanded coverage, removed things, added terms and conditions because of bad actors (more on that in the next point). It’s a great product that sells itself today, but it started with just putting it out there.

So the next time you say you’ve “always wanted” to do something, go do it today. You’re not getting any younger. And the older you get, the more life constraints you will have.

You will deal with bad actors

I’ve dealt with my fair share of bad actors as a creator. But bad actors in creator world are mostly haters. And haters don’t pay my bills. So who gives a fuck about them?

Dealing with bad actors as a founder hits differently — because now money is involved. And I believe price (money) is what you pay and value is what you get. And in every single dispute I have gotten, I believe I did not fail to deliver value.

People show their true colors when they have to pay. Serving early-career professionals, college students, and MBAs doesn’t help either, but I am sure a B2B business just has a different sets of bad actors.

I won’t bore you with all the details, but here’s the short version of how payment disputes impact my job board business. When a customer initiates a chargeback – the payment network (Visa/Mastercard) hits me with a non-refundable $15 fee. It doesn’t matter whether I accept the dispute, fight it and win, or fight it and lose. For a customer paying for one-month subscription at $10 or $12, it’s negative profit no matter what.

Recently, a buy-side analyst disputed two payments for access to my job board. He claimed he cancelled the subscription and still got charged, even though there is no record of him ever cancelling. I make enough money today that I thought, “Fine, I’ll accept it. My time is worth more than preparing documents to challenge the dispute." So I let him keep the two payments.

Big mistake.

Right after I accepted those two disputes, he filed another dispute tied to another past payment of his. That’s when it really clicked: when you give ground, some people don’t stop — they step further into your territory.

So I escalated and disputed the dispute. The verdict is still pending, and I may lose the $12 subscription fee, the $15 non-refundable network fee, AND an additional $15 dispute fee from Stripe if I lose. But the point isn’t the money. The point is making it clear that I’m not a pushover.

And of course, that person is permanently banned.

Going through the bad actors has made me far more aware of things I used to think were just formalities. Terms and conditions matter. Business laws and seeking legal support matter - a lot. They aren’t there for show. As a founder, I constantly update them to account for new ways people try to abuse the system. That’s just the cost of running a real business.

Over time, my dispute win rate has gone up because I now require acknowledgment of my policies. It’s also the key reason I raised my job board price to $19 per month. I only want to work with people who genuinely value what I do and want a real, fair business relationship.

Dealing with bad actors has made me more ruthless. And I’m okay with that.

Recently I read Michael Ovitz’s biography. Ovitz is the founder of Creative Artists Agency (CAA), one of the legendary talent agencies. CAA represented mega stars like Tom Cruise, Steven Spielberg, Leonardo DiCaprio.

When Ovitz started CAA, William Morris, the incumbent talent agency, sued CAA and tried to shut CAA out of the industry. Ovitz survived by playing hardball — redirecting the DOJ’s attention to the antitrust behaviors of the incumbents and forcing a truce. The lesson stuck with me: being “someone you don’t want to fuck with” doesn’t mean being an asshole. It means doing what’s necessary to survive.

The lesson for you: you shouldn’t be an asshole for the sake of it. But you also shouldn’t be a pushover. Bad actors exist in classrooms, in the office, in business, and you can’t eliminate them entirely. What you can do is protect yourself relentlessly — and make sure those people never get another opportunity to be part of your business or your life.

Conclusion

At the end of the day, turning a following into a business isn’t about hacks, luck, or being smarter than anyone else. It’s about creating real value, acting instead of overthinking, earning trust before monetizing, and being disciplined enough to protect what you build. The upside—ownership, leverage, and independence — comes with real risk and responsibility.

Thanks for reading. I will talk to you next time.

Please note: when I refer to “working for a company,” I’m specifically talking about roles without a meaningful variable compensation component. That excludes positions like sales, investment banking, or hedge fund roles, which sit in a gray area between traditional employment and entrepreneurship because pay is at least partially tied to value creation.

Want my insider takes?

8,000+ readers get my weekly insights on public equity research.