Stop Asking These Questions If You Want a Buy-Side Offer

After years helping candidates break into the buy-side, I’ve noticed a pattern: the biggest career detours don’t come from bad interviews — they come from bad questions.

- Questions that show you haven’t done your research (for the role a RESEARCH analyst)

- Questions that show you don’t understand what the interviewer is testing.

- Questions that show you’re trying to “hack” the process instead of mastering the craft.

These questions don’t just hurt your chances; they also lead you down months or years of investing in low return-on-invested-time activities.

Here are the most common ones — and why they send the wrong message.

“Thoughts on…”

I don’t know if this is a Gen Z thing, but I’m not joining your vibe-seeking experiment.

Everywhere I look online — and especially in my DMs — people start with “Thoughts on [broad topic]?” I never answer those. Not once.

Here’s why: you don’t really know what you want to ask, but you expect someone else to unpack the entire subject while you sit back eating popcorn. That’s lazy. If you don’t know, there’s no way the other person can give it to you.

And don’t try to rephrase it. “What do you think of [broad topic]?” “Your opinion on [broad topic]?” Same thing. I’m skipping those too.

But if you come prepared, someone might engage. Ask something like “Thoughts on why XYZ Capital’s TMT sector head left for a competitor fund?” That’s specific, it’s informed, and it shows you’ve done the work and know what you are looking for (though I just dislike the “thoughts on …” opening at this point as a pet peeve.)

If you want thoughtful responses, start by asking thoughtful questions.

“How to sound smart in a buy-side interview?”

Trying to sound smart will get you nowhere in this profession.

If you actually read a lot, it shows naturally in conversation. If you fake it, it gets exposed instantly in front of the well-read investors.

You don’t sound smart to get the job. You need to be smart, and that’s what gets you the job—and more importantly, keeps you performing once you’re in. There’s no coasting on the buy side.

People often get it backwards: they cram for interviews instead of building knowledge every day. But if you put in the work, your intellect shows effortlessly during the candidate vetting process.

And remember—the industry is full of smart people who still can’t make money. So if you’re not even smart? You’ve got no shot.

“What are my chances?" "How will it take?"

I can’t answer that — I’m not a fortune teller.

I’m also not a shrink, though that’s really what you’re looking for: reassurance. You want someone to tell you it’s possible. Well, it is possible — but it depends entirely on how hard you’re willing to work for it.

It’s going to be hard and unfair. You’ll be competing against insiders with experience (current buy-siders) and adjacent experience (IB, PE, ER).

But it’s doable. I’ve done it. Many others have done it. And every single one of them will tell you the same thing: it was really hard.

If what you’re really asking is, “Can I break into a hedge fund without suffering?” — the answer is no. You can’t. You must suffer.

Everyone’s timeline is different. Maybe it takes 6 months if you live and breathe this stuff and are laser focused. Maybe you’ll never make it because you want the glory and the money more than the grind.

“Will AI destroy HF jobs?”

No, but AI will shorten the grace period for juniors.

If you’re just a doer — someone who can model, write, and summarize but can’t make real investment calls — your career prospects were already limited. In an AI world, it’s harder for you to even land a seat.

That’s because the ramp-up time from joining a fund to generating alpha has collapsed. What used to take 1.5–2 years might now take 3–6 months. With quality prompting, AI lets you get up to speed on a company or a sector way faster than before.

But AI still can’t make quality investment decisions. It can process, summarize, and analyze — but not judge.

So, the people who can consistently make money will continue to be valuable in the post-AI world. The real shift is that junior recruiting will increasingly focus on your decision-making potential, not your ability to crunch numbers or write memos.

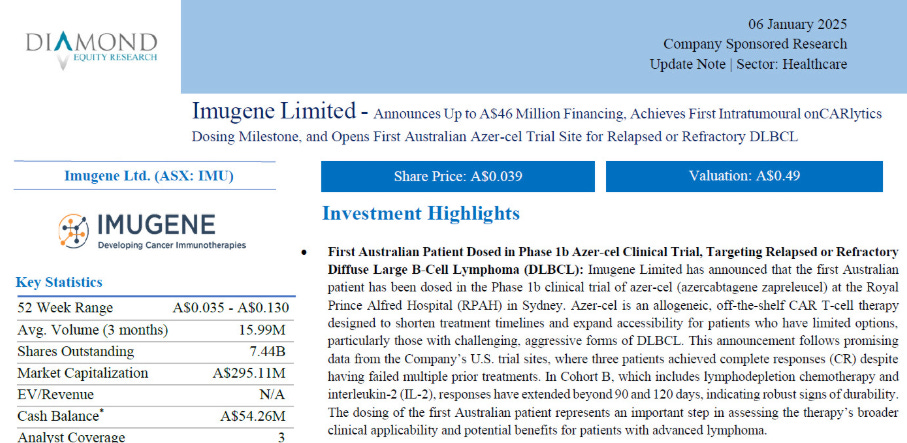

“Should I get an MD / PhD for biotech HF?”

It’s very hard to get into a quality MD or PhD program — and it’s even harder to finish one.

If you’re motivated purely by money — not by practicing medicine or doing original research — I’m skeptical you’ll have the stamina to push through when things inevitably get tough. And they will get tough. Without genuine passion for the subject, you’ll likely burn out or quit halfway.

An MD or PhD gives you deep technical knowledge — but trading biotech stocks requires judgment. It’s about calibrating probabilities of trial success, assessing management credibility, dissecting the incentives of doctors, patients, and payers, and weighing risk–reward — all things no graduate program will teach you.

So don’t assume that having a technical degree automatically earns you a seat in biotech public equity. You’ll still be competing against candidates who also have advanced degrees — and relevant investing experience on top of that.

And if you don’t already have an MD or PhD but say you want to do biotech investing — start by reading a biotech equity research report. See if you speak the language and enjoy the reading.

I read a note from the small cap biotech team when I was on the sell-side, and I didn’t understand a single word. That’s when I realized biotech was not a sector I ever wanted to have an opinion on.

“Which fund pays the best?”

You’re asking the wrong questions.

Focus on the your value add to your employer — not how fast and big you can get paid.

The media doesn’t cover juniors who get a goose egg year-end bonuses. It only highlights outliers. Do those million-dollar outcomes happen? Yes — but they’re rare.

And there are plenty of factors working against you: luck, the difficulty of landing those roles in the first place, and the reality that hundreds of people are chasing the exact same outcome. Chances are, you don’t have the shiniest background — nor are you already in the industry with a stellar track record.

Instead, focus on where you can be most valuable, learn the most, and work with the best mentors. That’s what sets up your long-term trajectory — not chasing the biggest bonus headline.

Value capture hinges on value add.

“Pod / long-only? Private / public? Credit or equity?"

Everyone’s going to give you a different answer —shaped by their own bias.

But here’s the truth: you should go where you can add the most value and feel the most alignment. That’s where you’ll stay energized coming into the office every day, hunting for ideas because you are aligned.

There is always an investment style or a sector that is in vogue at any point in time, doesn’t mean you are best suited to add value under that style/sector.

If you’re a long-term investor who joins a pod shop just because you heard about million-dollar bonuses, you’re setting yourself up for misery. When your PM expects ten longs and ten shorts going into every quarter, and you hate reacting to every ±2% move in your coverage universe, you’ll burn out fast — and end up right back at square one.

That’s why style and people alignment matter so much. If you get those wrong, you will struggle to add value on the job.

“I am a PM at an RIA, why do I struggle to land HF job?”

The median RIA focused on retail / wealth management is not held to the same risk and performance standard as an institutional hedge fund, even though a minority of RIAs may run institutional money. Unfortunately, human beings like to generalize: they tend to assume all RIAs are not as rigorous.

And most RIA professionals also don’t have the same educational or professional branding as hedge fund investment talents — so there’s a perception gap to overcome.

It will take a lot of convincing, with the same expectation that you should show your work (via stock pitch). If you believe you have the sophistication, the burden is on you to get noticed and to convince a hedge fund that you belong in the big league.

"What’s the Best Fund to Join This Year?"

Here’s the big point: there is zero correlation between a hedge fund’s return next year and what it did this year. For those who have taken a probability course, that’s called being memoryless.

So stop chasing last year’s top performer. You don’t know whether their returns came from skill, luck, or aggressive risk-taking.

When you chase the “hot” fund, you also ignore what actually matters:

- Do you align with their investment style?

- Do you like the people you’d be working with?

- Does your PM train and mentor juniors, or just burn through them? (A first-generation Tiger Cub has the reputation of burning through them)

If you don’t align with a fund’s philosophy, you can’t add value — and if you can’t add value, you’ll be gone before bonus season.

Also, remember: in your early years, your bonus isn’t tied to fund performance. It’s entirely discretionary. You could work at a top-performing fund and still get nothing.

Stop chasing headlines. Find a place where you fit — where you can grow, learn, and add real value. The money will follow over time.

"IB first, or straight to a HF?"

- If you want maximum optionality, do IB (and possibly PE) even if you’ll hate the lifestyle. After the grind, you can pivot to public markets, private markets, or corporates — all of which welcome ex-bankers.

- If you’re fully committed to public investing, skip the detour — go straight to the buy-side if you can prove yourself and land at a reputable shop.

If you’re already certain you want to do public investing and have a clear investment philosophy, joining a hedge fund right out of undergrad is worth the risk — provided the fund isn’t sub-scale (if you force me to give a cut-off, I say below $200 million, but fundraising can turn a $100 million AUM fund to $500 million over night if you can land a whale)

Programs like the Point72 Academy now offer structured training for undergrads — effectively a direct HF on-ramp. Personally, I wouldn’t do it because I’m not interested in market-neutral, but the experience is invaluable and increasingly recognized by other hedge funds.

That said, remember this tradeoff: if the fund’s founder doesn’t believe in pod-style, you will struggle to move from the pod shop to that fund. So your opportunity set will be smaller than the IB → PE → HF pipeline. But your life will probably be better than a banker’s.

"Must do PE for a Shot at a Tiger Cub?"

Getting a seat at a Tiger Cub hedge fund is one of the most competitive things on Earth.

Elite IB + PE experience is just the starting line. Tiger Cubs — and when they do, they only hire the best from that already elite pool.

I’ve done deep work mapping out every current and former employee at the first-generation Tiger Cubs. There’s almost no diversity of background: mostly Ivy League, top IB, top PE.

There are exceptions — but they’re rare, and statistically, you’re probably not one of them.

Also ask yourself: would you fit socially? The incumbents went to the same few schools, played lacrosse, joined the same societies, and worked at the same firms. Hedge funds are small — you’re in the trenches with these people every day. If you don’t mesh, you won’t enjoy it.

The good news: there are thousands of hedge funds that aren’t Tiger Cubs — many of which offer better learning and longevity.

"Which Funds Sponsor H1B Visas?"

Under the current political climate, very few do — and fewer will over time. If you’re an international student in the U.S., you need to be open to non-U.S. opportunities.

Your best shot is with a top multi-manager, a mega long-only, or a tier-1 hedge fund.

Even then, the odds are steep. Tier-1 hedge funds are already insanely competitive, and adding visa sponsorship makes it even harder.

"Which HF Is Truly Long-Term Oriented?"

None. No hedge fund is truly long-term oriented. At best, they are long-term aware.

The business model itself makes it impossible. Hedge funds charge management and performance fees. They have clients who can redeem money quickly, and they report performance monthly. You can’t claim to be long-term when you’re judged every 30 days.

And please, stop believing in their gospel of “private equity approach to public markets.” If an LP wants a private equity approach, they’ll invest in a private equity fund.

“Who’s the Best PM in [Sector XYZ]?”

This question trends on finance forums all the time. Someone posts it, and within minutes the thread fills with hundreds of pod shop PMs —no definition of “best,” and no consensus. It’s noise.

Here’s the reality: You don’t have bargaining power in this profession. You don’t get to choose to only work for “the best PMs” in your favorite sector.

Buy-side jobs don’t open often, and when a top PM does hire, they get hundreds of applicants — most of them already on the buy-side.

The bigger issue: you’re focused on what you want, not what you can offer. Most people asking this question have very little to offer those star PMs.

Instead of asking, “Who’s the best PM to work for?” ask, “How can I become valuable enough that the best PMs want to work with me?”

"How to Learn HF stock picking?"

The question has been answered thousands of times. The information is out there. If you’re reading this, you’ve already found your answer. Especially now, with LLMs (like ChatGPT), there’s no excuse for not knowing where to start.

If you need to be spoon-fed resources, you’re not going to make it in this business. Pursue another career path.

"Should I Get an MBA / CFA?"

You need to first diagnose why you’re struggling to land buy-side roles. In 99% of cases, a missing credential isn’t the root cause.

Both MBA and CFA are distributional enhancements — they help you get discovered and tell story better.

But if your product (your actual investing skill) isn’t strong, no amount of distribution enhancement will help.

I’ve written separately about both the MBA and CFA in the context of buy-side recruiting — read those if you want a deeper dive.

But if you absolutely believe you need one, fine — pick one. Never both.

"Which HF Lets Me Work Remotely?"

In a profession where osmosis accounts for most of your learning, working remotely will hurt your career, not help it.

If you’re not already a seasoned analyst or PM who can independently generate money-making ideas, stop looking for fully remote hedge-fund jobs.

You learn this business by sitting next to experienced practitioners — hearing how they think, watching how they debate, and absorbing how they size risk. None of that happens over a video call.

“Which Shop Can I Join So I Can Coast?”

You’ll only be able to coast at a hedge fund that’s also coasting — and all coasting hedge funds are on the path to shutting down.

If you don’t perform, you’ll be fired quickly. The grace period is roughly 1.5–2 years — and I assume your dream isn’t to clip one or two modest bonus checks before being shown the door. With the rise of LLMs, I expect the grace period to shorten because the analytical work becomes increasingly commoditized.

Hedge funds are not about work-life balance. Their selling point is flexibility. Yes, you might technically work 8–6, but in reality most people put in far more hours. The difference is:

- They don’t view it as “work” — they genuinely enjoy reading about businesses, sectors, and markets, even in bed or at the gym.

- They’re incentivized to work more, because every extra ounce of effort can compound into performance, and therefore pay.

Compensation in this business is tied to output, not input.

When you’re a senior investor who consistently makes money, no one cares whether you work 10 hours or 100 — as long as you produce results.

Flexibility comes from utility to the firm, not tenure.

Hope this is helpful. Thanks for reading. I will talk to you next time.

Want my insider takes?

8,000+ readers get my weekly insights on public equity research.