My 2025 Year-End Review

2025 was the year everything finally clicked. Audience grew in ways I didn’t expect, I learned more about building on the internet than any other year of my life, and three products have product-market fit. I am grateful for your support.

Here’s what worked, what didn’t, and where I’m taking this community in 2026.

2025 Results

Got Featured in Bloomberg

This January, I got my first major press feature on Bloomberg, and I’m still wrapping my head around the fact that memes + nerdy equity research content = Bloomberg calling you for commentary. The big lesson for you: it’s almost always better to dominate a niche than to be “kinda broad” and please no one.

- I had zero editorial input. I was mildly terrified they’d twist the narrative, but it ended up being positive - somehow the story both opened and closed with me.

- I didn’t know the publish date. I found out because HighYieldHarry tagged me on Twitter saying “congrats.” And then my Instagram DM blew up.

Anyways, I will be flexing “featured in Bloomberg” for the rest of my life and getting Kendall Jenner eye roll when I do so.

Business Has Finally Taken Shape

For those who are new here: I’ve been an Instagrammer since 2020. I didn’t anticipate becoming micro-famous in a niche corner of finance, and I definitely didn’t expect to end up pursuing entrepreneurship, let alone actually making it work (~50% of businesses fail within five years, right?). I am very grateful for your support and vote of confidence.

I quit my analyst job at a startup hedge fund in early 2022 and decided to build a business on top of my growing social media following. I had no idea what I was going to sell. The only thing I knew was that I wanted to stay on the education side as a business, not become an entertainer, because it's "easier" to me (both are hard, but relatively.)

After two years of testing, failing, and stumbling around, I found product-market fit with the equity research job board and helped many get buy-side and sell-side jobs and uncover openings that they never knew about.

By mid-2024, I realized I could go full-time without spontaneously combusting from financial stress. The job board’s monthly subscription revenue was growing steadily, and this year ended up being the moment the whole thing finally started to look like… well, a real business.

Three products found genuine traction:

- the public equity fund intelligence (hedge fund primers + deep dives)

- the networking/fund diligence course

- and the job board

But the job matching … yeah. More on that later in this review. Grab snacks.

Everything else stayed in the “high-ticket services” bucket - 1-on-1s for those who need tailored guidance, plus resume reviews that helped a few candidates with zero relevant experience land equity research interviews – strong marketing can solve product issues.

Converted to an S-corp. Hired a CPA. Hired a virtual assistant, she is wonderful, amplifying my reach on social, keeping operations moving, and allowing me to focus on building products and relationships.

2025 was the year the team grew beyond just “me, my laptop, and vibes.”

As I said in my 2024 review: to all the companies that did not give me an interview or a job offer (when I was looking to "go corporate"), thank you (for leaving me with no option but to make the business work.)

Audience Growth

My friend gave me a huge eureka moment this year: stop thinking of myself as a “social media creator” and start thinking of myself as a career coach who happens to have a growing social media following.

That framing made I care way less about merely chasing clout and way more about solving real problems for the people already in my world. My brand will always be more about the P(rice) than the Q(uantity) anyways: I serve an audience with very high earning power and net worth.

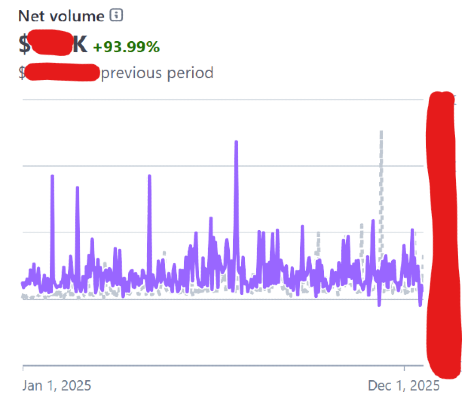

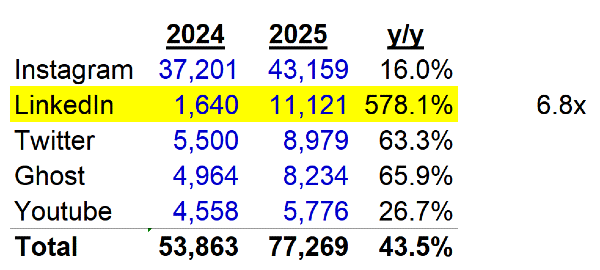

That said… LinkedIn went crazy this year.

I found content–audience fit and ended up with 6.8x my audience count from 2024 (I narrowly avoid the meme that I still have no idea what it means.) Great news, because LinkedIn is where my prospects actually are (how many hedge fund professionals are on Instagram really?)

But I’m not naïve. One algorithm switch and the whole thing can go dark. I’ve been publishing content for five years - platforms don’t owe you anything. Until numbers flatten, I’m prioritizing LinkedIn because other platforms have been throwing headwinds all year.

Below is the follower count year over year. I don’t have an earnings call-style explanation for the numbers, and I’m not giving guidance (Richard Toad stock probably tanked on that announcement). Let’s be real: who can forecast exponential growth accurately?

2025 Self-Evaluation

Built More Product

I spent the first half of 2025 building out the public equity fund intelligence —profiling 1,000+ hedge funds and mutual funds across the U.S.

Painful? Yes. Borderline deranged? Also yes. But it was fun. I learned a ton, and it made both my free content and my 1-on-1s significantly sharper.

Job matching, though… yeah. Major disappointment. To the 80+ candidates who were accepted: I’m sorry I haven’t been able to get your candidacies in front of more hiring banks yet. I’m not giving up, but it definitely hasn’t played out the way I hoped.

More on that in 2026 goal section.

In-Person Activities (I Will Keep Failing)

I am extremely good at hiding in my cave—reading, researching, publishing. And my product sells because I solve problems and know my stuff. But still… it would be nice to meet like-minded people.

I did make one big NYC trip for Andrew Yeung’s OOO Summit, where I befriended Varun Rana (aka. Pranav, King Suresh—the man has more personas than I have course modules).

I also forced a group of founders to follow me on Instagram, which bumped me to 40k followers. “Do things that don’t scale,” right, Paul Graham? Money well spent.

Video Production

I completely slacked here. Yes, the business grew just fine without YouTube. But in an AI-saturated world, being a real person with a face, eyes, nose, and legs is more important than ever.

Being an engaging storyteller on camera is still out of my comfort zone. But right now, even a bland talking-head video with minimal edits is powerful for future-proofing my personal brand. So yes—I need to get back to video.

2025 Learnings

I still have no idea what I’m doing half the time, but taking a step back, I can see that I’m learning by doing. Here are a few lessons—for me, and hopefully for you too.

Multi-Platform Is the Way

When my Instagram growth first stalled, I started posting on other platforms. I didn't know what gets views, but I just kept going and trying - then it started working on Twitter and LinkedIn.

In hindsight: correct move.

Even though IG eventually started growing again, I can feel the IG algorithm again drifting back toward short-form video. Unfortunately, I am not that short form video guy just yet.

Thankfully, business growth was fine thanks to customer conversion on other channels. Clout is nice. Conversion is the real game.

But multi-platform comes with its own headaches:

- Good thing is the operating leverage: Long-form → repurpose → distribute to multiple platforms, but every platform needs content that actually performs

- Twitter was great… until Nikita Bier (new Head of Product at Twitter) came up with a new algorithm

- LinkedIn is amazing right now… but could die tomorrow

Social media platforms are businesses. They do what’s best for them. Kim Kardashian complained about IG abandoning photos, but IG still prioritized Reels because TikTok was eating their lunch.

It reminds me of David Einhorn complaining that “value investing doesn’t work anymore.” The answer is always the same: adapt or die.

I am not happy but I get it. The only thing I can do is to control what I can control, which is to add value to my audience. And the most durable channel? Email. Newsletter. Everything else is rented attention.

Learn to Sell

Even with product-market fit, selling harder is my next frontier.

When I teased upcoming releases every week for the public equity fund intelligence, sales exploded because people were anticipating each release—especially bangers like the New York biotech hedge fund primer (biotech is hot right now). But after the entire intelligence database was built, sales slowed, I didn’t know how to reignite the growth.

Alex Hormozi famously said every business owner undersell, and he’s right. I need to rethink my funnel and create more touch points so prospects are aware the product exists and they understand exactly how the product helps them save time, avoid style mismatch, and improve offer conversion.

Invest, Not Save

This entire year was one long, painful lesson in false savings. I have talked about my flaw of being cheap before - I suspect the core cause is risk aversion.

I left Substack because I didn’t think Substack's 10% revenue cut is justified. I migrated the paid content to Squarespace. Huge mistake. Endless manual work that could’ve been avoided if I just paid for a better newsletter tool:

- The text editor is terrible. Random blank spaces everywhere

- Had to manually email paid articles

- Free content on Substack + paid content on Squarespace = clown-level complexity

Eventually I moved to Ghost (what you are reading right now): The migration was smooth with a technician. The platform is lightning fast. It's highly customizable if you learn HTML/CSS/JavaScript from an LLM. BUT Ghost has no built-in network effect, so I accepted I shouldn’t obsess over growing free subs. My focus is conversion.

In hindsight, I should’ve just paid for Ghost from the start instead of migrating twice and wrestling with atrocious Squarespace’s text editor.

Time wasted that I could’ve invested somewhere that actually mattered.

Looking ahead – 2026

No new product ideas at the moment, but ideas will come from great people around me. I will let the ideas come to me. It's more about the execution, not the idea anyways. I am getting followed by hedge fund founders and endowment CIOs left and right, I am honored but as of now, I don't know how to add value to them.

I’d rather run fewer products extremely well than launch 10 mediocre ones that don’t sell. The focus for 2026 is improving what already works.

I will make a major push on job matching. If you are a hiring decision maker in sell-side equity research looking for qualified equity research candidates who are vetted by me, let’s discuss how I can save you time in finding qualified candidates who are passionate, competent and grateful. This is my first real B2B initiative. I am not ready to tap out.

Fund intelligence alone has an endless backlog: more hedge fund deep dives, more coverage of faded funds, and a refresh cycle starting in March 2026 once the 2025 filings drop so we know which fund has shut down and what are the new launches. I have already featured some high-profile ones and Jack Woodruff's Candlestick Capital is reported to shut down as I finalize this article.

Internet businesses are open-ended: DoorDash drifted into Yelp’s lane, e-commerce platforms added payments (eg. Mercado Pago, SeaMoney) - lot of optionality in what Richard Toad can turn into.

I could do a podcast. I could start a community. I could do in-person events (been wanting to.) Bottom line: ideas are plenty. Execution is the hard part.

I’m awful at advertising revenue right now. I’ve always thought ads are winner-take-all, but talking to people at events has made me think I might be wrong. It’s something I could fix if I wanted to, by meeting corporate partners in person.

Running a business is like running a marathon that never ends. I don’t always know where it’s headed, but it’s my responsibility - and mine alone - to steer the ship and keep pushing forward. It’s been a ride, and I’m looking forward to another year of adventure.

That’s a Wrap. Thank you so much for reading and joining my journey.

Happy holidays and I’ll talk to you in 2026!

Want my insider takes?

8,000+ readers get my weekly insights on public equity research.