Harris Associates - U.S. Equity

In 1976, a small group of investors working inside the family office of Chicago entrepreneur Irving Harris set out to build something different. They founded Harris Associates L.P. to learn how to think about businesses the slow, owner-oriented way—patient, independent, and grounded in fundamentals.

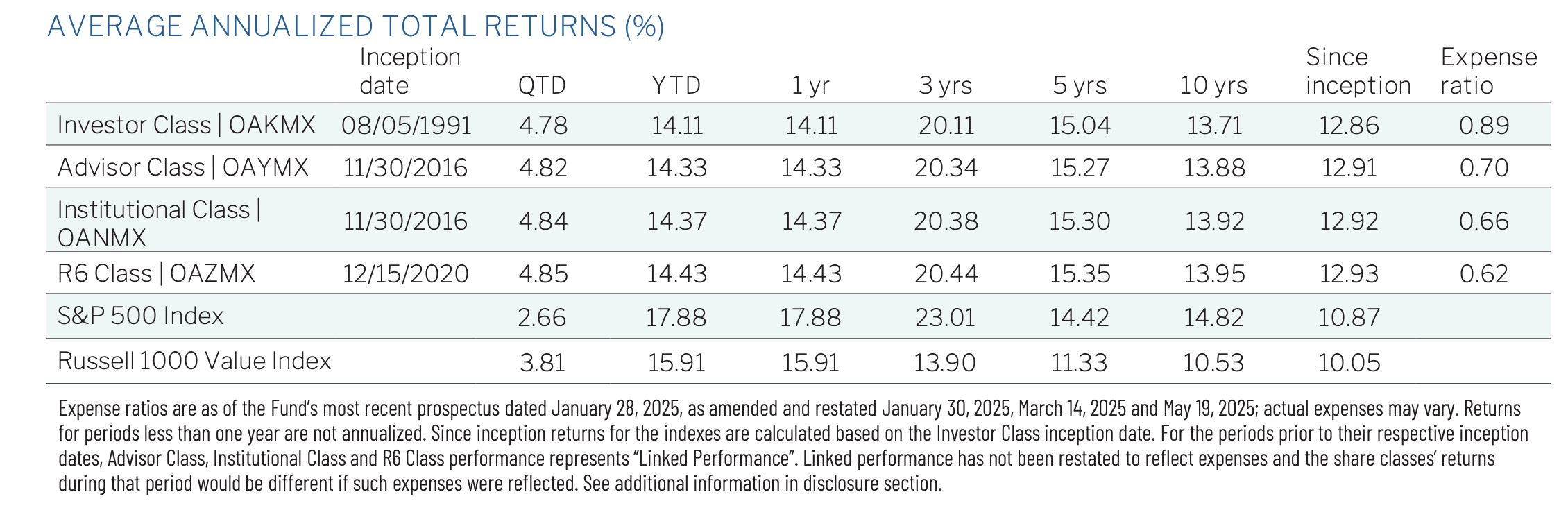

In 1991, the firm launched the Oakmark Fund. It wasn’t designed to chase trends or follow momentum. It was built to wait, to act early, and to stay comfortable being wrong before eventually being right. A year later, Harris applied the same philosophy internationally, extending the playbook beyond the U.S.

Today, Harris Associates manages close to $100 billion. The U.S. equity is led by Bill Nygren, while the international equity is co-run by David Herro and Tony Coniaris.

In this deep dive, we focus on the U.S. side of Harris Associates — Bill Nygren’s story, how the team generates ideas, how it identifies actionable stock opportunities, and the backgrounds of the investment team.

Bill Nygren

Before Bill Nygren ever thought about valuation multiples, he was obsessed with baseball stats.

Growing up, he loved numbers and patterns. The sports section was his favorite part of the newspaper. The business section just happened to sit right next to the baseball box scores. One day, he started drifting over—looking at stock prices the same way he looked at batting averages. The curiosity stuck. Numbers told stories. Markets felt like games with rules, odds, and mis-pricings.

As a teenager, Nygren was introduced to games of chance. He took trips to Las Vegas with his father and cousin—not just to gamble, but to observe how odds worked, how people behaved, and how expectations often diverged from reality. In hindsight, it wasn’t that different from value investing.

That path led him to the Applied Securities Analysis program at the University of Wisconsin–Madison, where he earned an undergraduate degree in accounting and a master’s in finance. The required reading—Graham, Dodd, and the rest of the value canon—locked it in. This was how he wanted to invest: fundamentals first, price second.

After graduate school, Nygren joined an insurance company as a retail-sector equity analyst. The job taught him two formative—and frustrating—lessons.

Want my insider takes?

8,000+ readers get my weekly insights on public equity research.