"Going corporate" from public equity jobs? Not the straightforward move you think

If you have spent your whole career in public equity, whether on the sell side, at a hedge fund, a mutual fund or a family office, it feels natural to think going corporate should be easy. You know business models. You have built countless forecasts. You have talked to management teams for years. Roles like FP&A, Corporate Development, Investor Relations and Strategic Finance should map cleanly to what you already do.

But the truth is the transition is not smooth. It often feels like starting over.

Here are the challenges public equity professionals run into and lessons from my own failed attempt to go corporate.

The profession is not understood

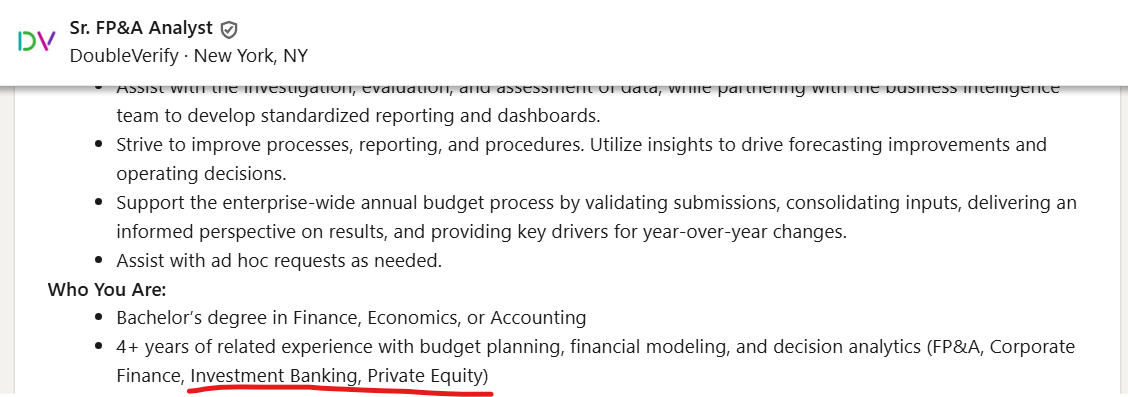

Companies simply do not understand the public equity skill set. Job descriptions rarely mention equity research or buy side backgrounds but almost always list banking or consulting. Recruiters follow the template and ignore your resume.

I lost count of how many outsiders think public equity investing is just day trading. They think you are too short term and that you do not understand how a company actually works. Because of that misunderstanding, applying online rarely gets traction.

In public equity, you can show your work with stock pitches. Internal finance has no equivalent. You cannot prove you can do the work unless you get into the room first.

Bankers and consultants head start

Corporate teams are filled with ex-investment bankers and consultants. Their alumni networks are huge and companies understand their training.

Public equity teams are tiny. A sell side sector team might be five people. Buy side teams can be even smaller. Your network is thinner and the number of corporate leaders with public equity backgrounds is even smaller.

I have profiled hundreds of executives and founders. For every Sarah Friar, Charles Phillips or Anthony Noto, there are ten Ruth Porats on the corporate side. The numbers do not favor us.

Public equity people operate with the outside view: you do not get customer lists, product level margins or internal dashboards. Corporate teams think professionals with experience working with internal data are more relevant. People from banking, private equity, consulting and accounting already have this inside view, so they are seen as a safer bet.

Job title doesn't show progression

Public equity titles barely move. You can be a sell side associate for years even with dramatically more responsibility. Buy side titles are even flatter. Corporate recruiters see that and assume you stalled, even though it is normal for the industry. This makes the resume screening stage difficult.

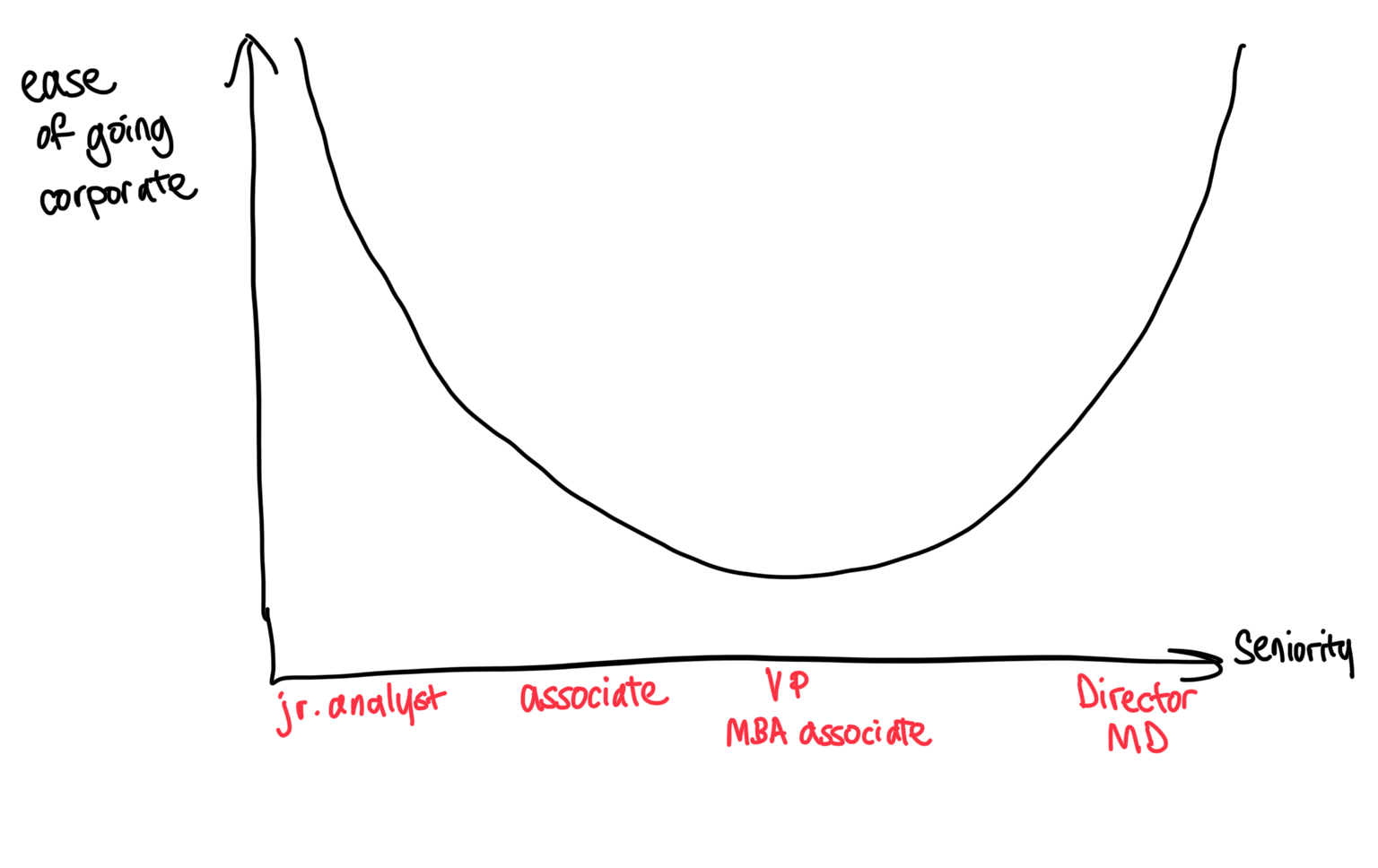

Moving corporate is basically U-shaped. If you’re early in your career (2–3 years in ER or at a fund), it’s usually fine. You’re not taking a huge pay cut, and the analyst title still maps. If you’re very senior (MDs or PMs with C-suite relationships), you can often jump straight into an exec role through your network without ever applying online.

The hardest spot is mid-career. You don’t want to step down to a Senior Analyst role, but companies don’t think you have enough “internal” experience to manage people and carry a Manager title. So you get stuck in the middle. They’re hesitant on comp and skeptical about skill transfer. Ironically, the skills are very transferable. The perception just isn’t there.

Pre-set avatar for each function

Companies already have a clear picture of who belongs where. Corporate development hires bankers. Strategy hires consultants. FP&A hires accountants. Investor relations is open to equity research people, but seats are limited and seniority matching is tricky. You might be too experienced for a junior IR role but not quite right for a director level one.

Lack of teamwork and managerial experience

Public equity is very autonomous. You interact with IR, CEOs, experts and other investors constantly, but the analysis is done mostly alone.

Inside a company, teamwork is constant. People management becomes part of your progression. Hiring managers often assume you have no leadership experience and may not fit the collaborative nature of internal finance. They do not realize that managing CEO conversations is harder than managing junior analysts.

Mid-career is the hardest

Early career people switch more easily because they have flexible titles and lower pay expectations. Very senior people switch because they have relationships with CEOs and CFOs.

Mid-career people like me have the toughest path. Companies think you are too senior to enter as a senior analyst but not experienced enough to be a manager.

Cultural barrier

This is my speculation, but I suspect some corporate people quietly resent Wall Street people. They see them as overpaid or arrogant. On the other side, many Wall Street people think corporate operators are slower or less sharp. That tension makes both sides defensive.

You need to show humility when interviewing and avoid projecting superiority.

For sell-side equity research, I have discussed the additional issues previously.

So what to do?

I never landed a corporate finance job myself, so take this as lessons learned, not guaranteed advice. But here is what I saw and what others who made the transition taught me.

Target the lowest barriers

Investor relations and FP&A are most open to public equity backgrounds. Strategic finance and strategy lean heavily toward banking and consulting. Business operations in tech can also be a good fit because it values hypothesis-driven, data-heavy, model-heavy work.

Your Story Matters

Interviewers know you are burned out and just want a less stressful job. Do not say that.

Tell them you want to operate, not just analyze. Tell them you want to understand how things work internally. Tell them you want to contribute to real decisions over time.

Tailor your story to each team. FP&A cares about forecasting. Strategy cares about industry research. IR cares about communication and KPI storytelling. Corporate development cares about deal work.

Of course, do not speak poorly about public equity. Just explain why you want something different now.

Speak their language

Corporate people do not understand what it means to cover companies or pitch stocks. Translate everything into what their job is:

- Built detailed 3 statement models → Forecasted revenue, expenses and cash flow

- Covered 20 plus companies → Managed competing priorities across multiple business lines

- Wrote investment theses → Synthesized complex data into decisions

Sell value to who is buying.

Learn Technical Tools

It helps to know the basic tools used internally. Teams use systems like Anaplan, Adaptive Insights, Workday Planning, SQL, Power BI and Tableau. You do not need mastery. Even light familiarity helps you sound credible.

Thanks to my data background, I already had skills such as SQL and Tableau, but for those who had the luxury of joining public equity from college, you might want to pick up these skills because working with data is a valuable skill.

Slower, but more politics

Corporate life is slower in analysis but harder on the people side. You will deal with many teams. Internal finance roles are like mini CFO jobs. Emotional intelligence and patience matter.

I have heard stories of finance managers getting overridden by product managers because the PM wanted a promotion and needed a yes from finance. It is not always as intellectually honest as investing. Sometimes you have to let a clearly losing product launch so you can win a different battle later. These things happen inside companies all year long.

Investor relations is the most cross functional and the most political. The benefit is that once people trust you, you can rotate into almost any internal finance function.

Choose the Right Type of Company

It is easier to lateral into the industry you used to cover. Sector expertise is valued.

Company stage matters too. Early stage companies are flexible and open to non linear paths. A lot of the senior members on the finance team come from Wall Street as well. They give more responsibility but the hours and stress are higher, and it's less stable.

Mature companies offer stability and clearer processes but more politics, slower growth and sometimes boring work.

Neither is good or bad. It depends on your life stage and goals.

Networking Is the Real Gatekeeper

Getting the interview is the hardest part. Doing the interview is easier. Most of my interviews came through ex-Wall Street or ex-equity research people.

Aim upward. Directors and VPs have more influence on hiring than junior analysts. Public equity folks are used to talking to executives, so you should be comfortable in front of mid to senior level corporate professionals.

Expect a Pay Cut but Be Smart About It

Going corporate usually means lower pay. You gain work life balance and a more stable career path in exchange for a title reset.

Do not undersell yourself. You simply need to understand the tradeoff. You are balancing pay, title and the time it takes to get your first seat. Different people prioritize different things. There is no perfect combination.

If you do make the jump, I would love to hear what you learned.

Thanks for reading. I will talk to you next time.

Want my insider takes?

8,000+ readers get my weekly insights on public equity research.