Public Equity Fund Intelligence

You waste months pitching the wrong stocks to PMs, because you don't know which funds suit your investment style.

Every PM has an ideal candidate profile. By the time you figure it out, the role is gone… and so is your shot.

That’s why I built Public Equity Fund Intelligence — a database of intel on 1,000+ hedge funds and mutual funds.

For <0.1% of your first-year pay, you can land a $300K+ buy-side seat faster and skip months of trial and error.

If you’re serious about breaking in, get the intel so you don't get ghosted again.

Please read the FAQs if you have any questions.

Where some of our premium readers studied

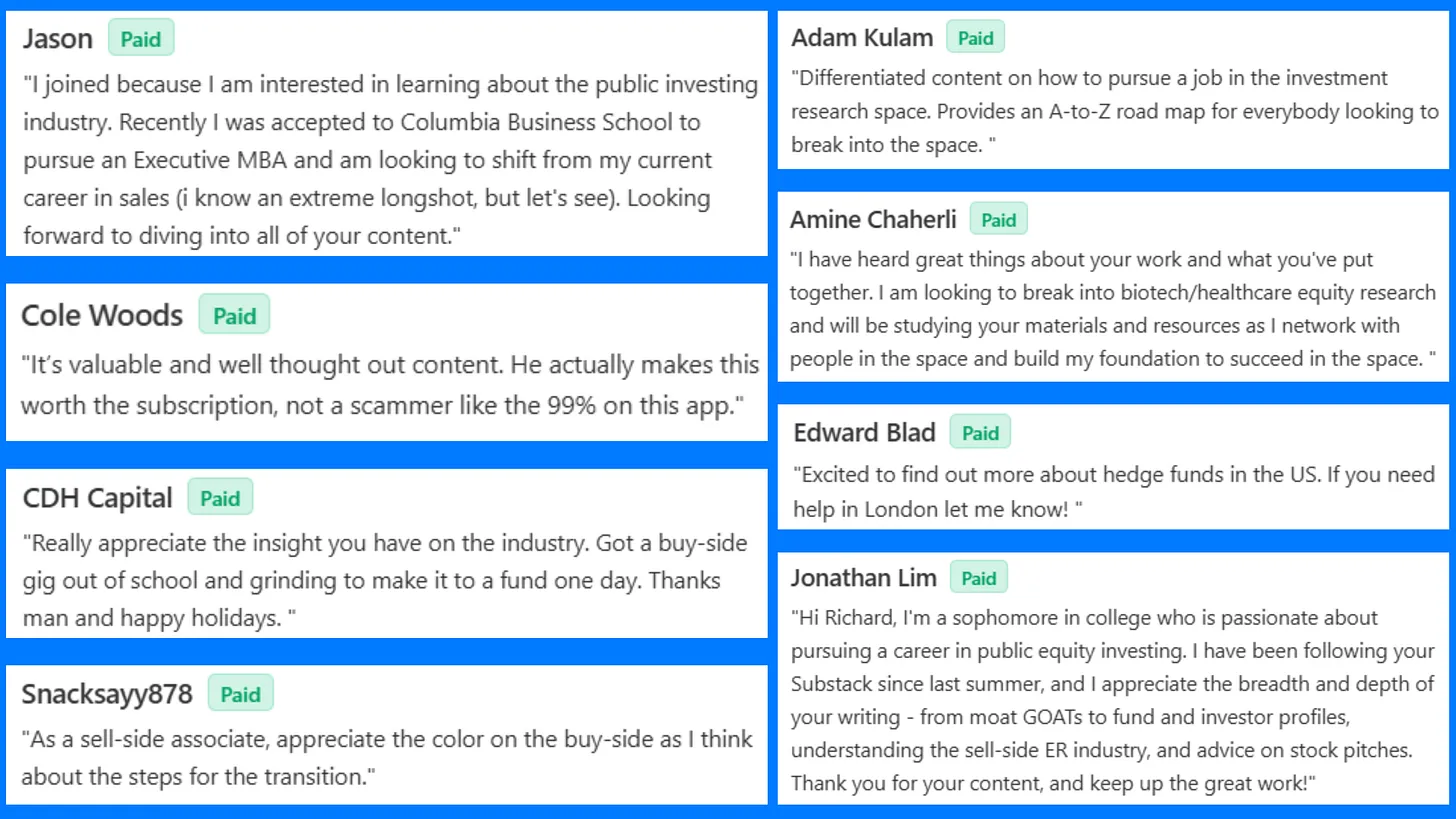

What others are saying:

Save time and maximize your shots on goal with instant access to a deeply researched list of 1,000+ funds tailored to your exact criteria—region, sector, style, and founder lineage. Each primer covers both hedge funds and long-onlys, unless specified.

Quarterly HF Monitor (Free for all subscribers, including free tier)

By region

- New York City HFs: Tiger-lineage | Biotech | Activist | Market-neutral Single-manager | Event-driven / Special Situation | Value, Growth, Style-agnostic

- New York City: Long-onlys

- Connecticut | New Jersey | U.S. Mid-Atlantic (MD, PA, VA, DC, DE)

- Boston and U.S. Northeast (free preview available)

- California - Northern (San Francisco Bay Area) | California - Southern (Los Angeles, San Diego, Orange County) | U.S. West and Puerto Rico (AZ, CO, HI, NV, NM, OR, UT, WA)

- Chicago | U.S. Midwest (IA, KS, MI, MN, MO, NE, OH, WI)

- Florida | Texas | U.S. Southeast (AL, AK, GA, KY, NC, SC, TN)

By sector focus

Biotech / Healthcare | TMT / consumer | Energy / Materials | Financials | Real Estate

By style

Activists | Tiger-lineage | Market-neutral | Event-driven | Multi-managers

By founder’s (or key person’s) alma mater

Columbia | Cornell | Dartmouth | Harvard | NYU | UPenn / Wharton | Princeton | Stanford | UVA | Yale | University of Chicago | Williams College

The Hedge Fund Deep Dives will allow you to skip the hours of fund diligence so you can focus on crafting stock pitches that align with the firm’s DNA.

What a deep dive can contain: history of the firm's founding, its investment philosophy, research process, and the profiles (education, career path before/after working at the firm) of its investment team.

Abrams | Baron | Cantillon | Coatue | Davidson Kempner | Eminence | Glenview | King Street | Lone Pine | Maverick (FREE) | Soroban | Sands | Third Point | ValueAct | Whale Rock | Baupost (FREE)

The Hedge Fund Lineage series traces the industry back to a few iconic firms—showing who spun out, what they believed, and how their rise or decline shaped today’s hedge fund world.

GS Risk Arb | Pequot Capital | Tiger Management (TBD) | more to come

Same but for mutual fund (long-onlys.)

Artisan International Value | Diamond Hill | Harris Associates - U.S. Equity | Polen Focused Growth | Pat Dorsey (FREE) | Todd Combs (FREE)